[By Idowu Faleye: +2348132100608]

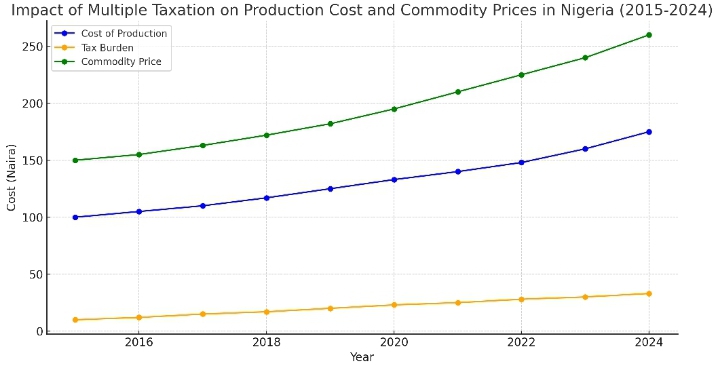

The conversation around tax reform is reaching a fever pitch in Nigeria. The current situation is one where businesses, both big and small, struggle under a punishing burden of taxes from every level of government—federal, state, and local. This overlapping multiple tax burdens down production, drives up the prices of everyday commodities, and erodes purchasing power for ordinary Nigerians. For citizens simply trying to survive, the rising cost of food, housing, and other essentials adds a daily burden they can barely shoulder. Every new tax pushes the cost of basic necessities further out of reach, and every price increase hits the pockets of every family.

The proposed tax reform bills, designed to eliminate multiple taxation and streamline the country’s tax processes, should offer a glimmer of hope. These reforms aim to unify and simplify tax collection, reducing the strain on businesses and ultimately benefiting consumers. However, behind closed doors, a fierce resistance is already taking shape. The tax reform bills, if passed, would challenge powerful vested interests, and threaten a well-established system.

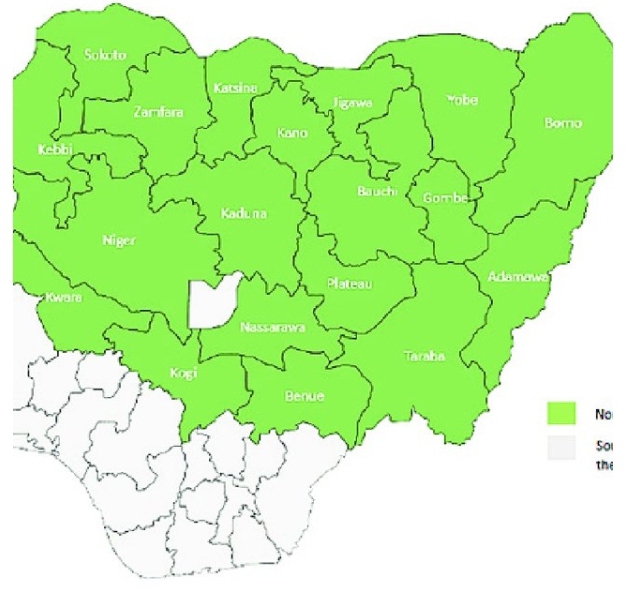

Opposition has started to gather momentum against the proposed tax reform bill, and this highlights the political complexity of such a venture in Nigeria. This resistance is a clear signal of the hurdles that lie ahead. Tax reform is a tough sell in a fragmented country like Nigeria, where regional tensions run deep, such changes are often seen through a political lens rather than a national one. Hence, these reforms risk stalling indefinitely, regardless of the benefits they might bring to the broader economy. Yet, without a unified tax approach, Nigeria’s dream of a streamlined tax system that will support economic growth and reduce commodity prices will remain just unattainable dream.

What is Multiple taxation? Multiple taxation refers to the scenario where businesses and individuals are subject to a variety of overlapping taxes from federal, state, and local authorities. Over the years, Nigeria’s tax framework has become an intricate web of levies and charges, making compliance not only expensive but also complex and time-consuming. These layers of taxation have evolved as different jurisdictions impose their taxes, leading to administrative fragmentation and confusion among taxpayers.

In Nigeria, taxes like Company Income Tax (CIT), Personal Income Tax (PIT), Capital Gains Tax (CGT), Petroleum Profits Tax (PPT), and Value-Added Tax (VAT) are each governed by distinct regulations. This fragmented structure has created an environment where businesses face burdens from all levels, stifling productivity and discouraging new investment.

For any economy to thrive, affordable and stable prices are crucial. Yet, in Nigeria, the excessive tax burden inflates production costs, which, in turn, increases the prices of commodities. High prices create a ripple effect, impacting everything from small businesses trying to survive to households struggling to afford basic goods. A study by the Lagos Chamber of Commerce and Industry (LCCI) found that 82% of Nigerian businesses report that multiple taxes are a significant barrier to growth, with each additional tax adding to the cost of production and ultimately inflating consumer prices.

Nigeria’s tax administration is characterized by scattered structures where different levels of government impose taxes on similar business activities. This overlapping responsibility has created significant inefficiencies, with federal, state, and local agencies often collecting taxes independently. The lack of a coordinated approach has led to widespread confusion and redundancy, as businesses navigate complex and inconsistent tax requirements. This structure drains both businesses and discourages new investment.

Across Nigeria’s states and local governments, tax policies differ significantly. For instance, a business operating in Lagos might face different tax obligations than one in Kano, despite performing identical activities. This inconsistency complicates operations, as businesses must adapt to varying regulations and deal with unpredictable costs. Furthermore, inconsistency breeds legal challenges, with companies facing penalties in one state for practices considered compliant in another.

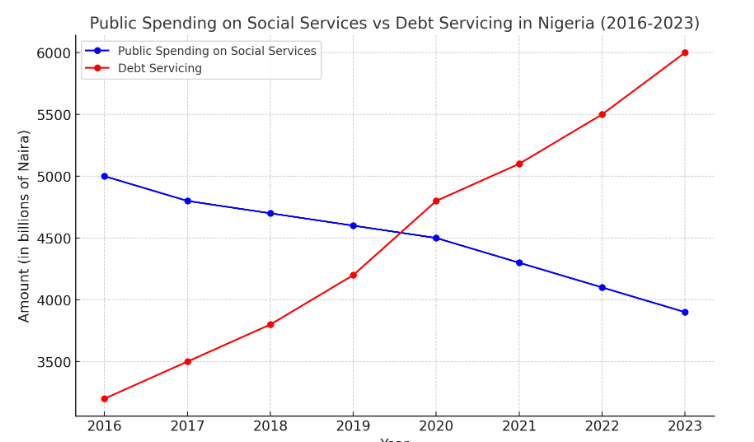

The lack of coordination among tax authorities leads to higher administration and compliance costs. According to PwC’s 2022 report, inefficiency in Nigeria’s tax collection costs the country up to ₦5 trillion annually in potential revenue. This inefficiency trickles down to businesses, which must allocate resources to fulfil multiple tax obligations, detracting from their ability to reinvest in growth or innovation.

The manufacturing sector is particularly affected by multiple taxation. The excessive tax burden on raw materials and production processes inflates costs, making Nigerian products less competitive globally. A recent analysis by the Manufacturers Association of Nigeria (MAN) revealed that taxes contribute up to 20% of production costs for many companies. With each tax increase, manufacturers must either absorb the cost or pass it on to consumers, resulting in higher prices for Nigerian-made goods.

Read Also: Poor Service Delivery in Nigeria: Who Is to Be Blamed for Approving Substandard Projects?

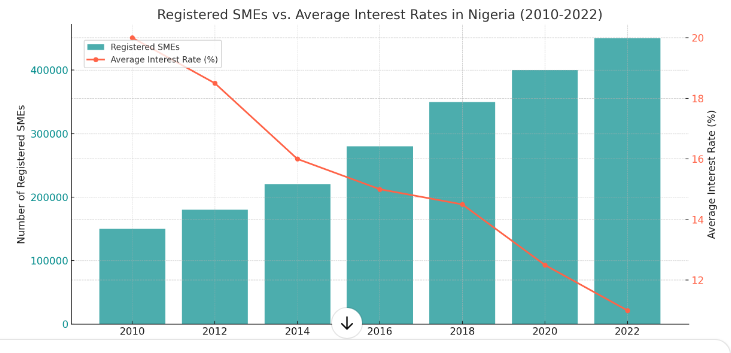

For small businesses, navigating the complex tax landscape is even more challenging. Many of these enterprises lack the resources to hire tax consultants, making it difficult to comply with multiple tax regulations. As a result, numerous small businesses operate informally to avoid the high costs associated with compliance. However, this stifles their growth potential and limits their ability to contribute to the formal economy.

The effect of taxes like VAT and local levies on traders and retailers ultimately affects consumers, as these businesses often transfer the burden to customers. This has led to significant price inflation, eroding Nigerians’ purchasing power and impacting the cost of living. A 2023 report from the National Bureau of Statistics (NBS) indicated that consumer prices increased by over 18% in part due to the indirect effect of high taxes on retail goods.

Nigeria’s Consumer Price Index (CPI) has consistently risen, correlating with the increasing tax burden. For instance, between 2020 and 2023, VAT increases contributed to a 14% rise in consumer prices across essential goods like food and clothing. Additionally, data from the Central Bank of Nigeria (CBN) suggests that each 1% rise in tax rates leads to a 2.5% increase in production costs—a burden ultimately borne by consumers. These statistics highlight the pressing need for reform to reduce the tax-related inflationary pressure on Nigeria’s economy.

Multiple taxation does not just affect businesses; it also has significant societal repercussions. Rising commodity prices due to excessive tax burdens increase the cost of living, with low-income households bearing the brunt of these increases. High taxes on necessities like food and shelter exacerbate economic inequality, widening the gap between wealthy and low-income Nigerians. As more households struggle to afford basic goods, social stability is threatened, and public dissatisfaction grows.

Read Also: Outdated Laws, Modern Realities: The Urgent Need to Modernize Nigeria’s Legal Framework

When businesses face high operational costs due to taxes, they are less likely to expand or hire additional workers. Many companies instead opt to downsize to stay afloat. This stunts job creation and reduces productivity, depriving the economy of potential growth. According to the World Bank, Nigeria’s unemployment rate could decrease by 4% if businesses were less burdened by excessive taxes, underlining the importance of a favourable tax environment for economic growth.

The proposed tax reform bills aim to consolidate Nigeria’s fragmented tax system. By merging overlapping taxes into a unified structure, the government could reduce the burden on businesses and improve administrative efficiency. For instance, the Nigeria Tax Bill proposes eliminating unnecessary levies, while the Nigeria Tax Administration Bill (NTAB) seeks to harmonize processes across federal, state, and local jurisdictions. Together, these reforms would make it easier for businesses to comply, lower their tax-related costs, and promote economic growth.

Read Also: Be Wary of World Bank’s Advice: A Cautionary Counsel for Nigeria Government

A streamlined tax structure would also ease the operational complexities currently stifling Nigerian businesses. Simplifying tax obligations could attract foreign investments, as investors often prefer predictable and straightforward tax environments. Furthermore, with clearer and more transparent regulations, businesses would be more likely to comply with tax laws, improving overall revenue collection.

Global examples underscore the benefits of streamlined tax systems. India’s introduction of the Goods and Services Tax (GST) significantly reduced administrative burdens and boosted GDP by an estimated 2% annually. Similarly, South Africa’s VAT reform improved compliance and stabilized consumer prices. If implemented, Nigeria’s tax reform could replicate these successes, enhancing revenue without increasing tax rates.

For instance, India’s switch to GST simplified its tax landscape, reducing hidden costs and streamlining compliance. This increased economic growth by reducing administrative inefficiencies, making India a more attractive destination for investment. For Nigeria, adopting a similar unified tax system could simplify compliance and unlock economic potential.

Similarly, South Africa consolidated its VAT policies across regions, improving compliance and reducing consumer price volatility. Nigeria could see similar benefits by consolidating VAT and other taxes, which would help maintain stable prices and alleviate the tax burden on consumers.

Also, Estonia’s e-taxation model exemplifies how technology can streamline tax processes, making compliance easy and transparent. Nigeria could leverage technology to modernize its tax administration, increasing transparency and making compliance simpler for all stakeholders.

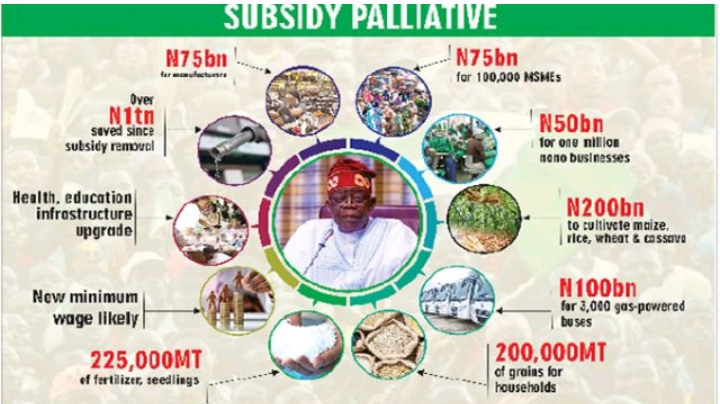

In sum, Nigeria’s multiple tax burdens have held back its economy for far too long, raising costs for businesses, driving up consumer prices, and impeding economic growth. The proposed tax reform bills, currently before the National Assembly, offer a pathway to a more competitive market where production costs are lower, goods are affordable, and businesses can grow without being weighed down by unnecessary taxes.

For Nigeria to achieve sustainable economic growth, tax reform is essential. The National Assembly must consider these bills not as political leverage but as a necessity for national progress. By unifying taxes, Nigeria can lay the foundation for a robust economy where businesses thrive, citizens benefit, and the nation reaches its full potential.

References:

PricewaterhouseCoopers (PwC) – Nigeria’s Tax Environment and Multiple Taxation

International Monetary Fund (IMF) – Tax Administration Reforms in Low-Income Countries

World Bank – Nigeria’s Economic Update: Tax Reform as a Catalyst for Economic Growth

National Bureau of Statistics (NBS), Nigeria – Effects of Multiple Taxation on the Nigerian Business Climate

Federal Inland Revenue Service (FIRS), Nigeria – The Nigerian Tax System and the Push for Tax Reforms

The Impact of Taxation on Small and Medium-Scale Businesses in Nigeria by Economic Policy Research Centre (EPRC).

Political Economy of Tax Reform in Nigeria” by African Development Bank (AfDB)

International Journal of Economics and Financial Issues – Effects of Multiple Taxation on the Profitability of Nigerian Businesses

.African Tax Administration Forum (ATAF) – Global Lessons in Tax Reform for African Countries

Idowu Faleye:Ekiti-born Policy Analyst, IBM-certified Data Analyst, and Lead Analyst at EphraimHill Data Consult. Publisher of EphraimHill DataBlog, addressing topics of public interest. Reach him via WhatsApp at +2348132100608 or email ephraimhill01@gmail.com.

© 2024 EphraimHill DC. All rights reserved.📊🇳🇬

![The Trend of Insecurity in Nigeria. [Part 2]](https://ephraimhilldc.com/wp-content/uploads/2024/09/Computer-Monitoring-of-Remote-areas.png)