[By Idowu Faleye: +2348132100608]

The recent economic advice from the World Bank to Nigeria has stirred considerable debate, and for good reason. The World Bank, a global financial institution with significant influence on policy decisions in developing nations, recommended a reduction in government support for social services. In response, the pan-Yoruba socio-cultural and socio-political organization, Afenifere, issued a stern warning to the Federal Government, urging caution and discernment in accepting such advice. The question is: Which path should Nigeria follow, especially in the face of its current economic crisis?

With an economy battered by inflation, increased oil price, and floated foreign exchange, Nigeria citizens are already enduring severe hardship. The World Bank’s proposal to cut social services comes at a time when millions of Nigerians are reliant on these services for survival. Education, healthcare, and basic welfare programs serve as lifelines for many, and reducing government support would be disastrous for the country’s poorest and most vulnerable populations.

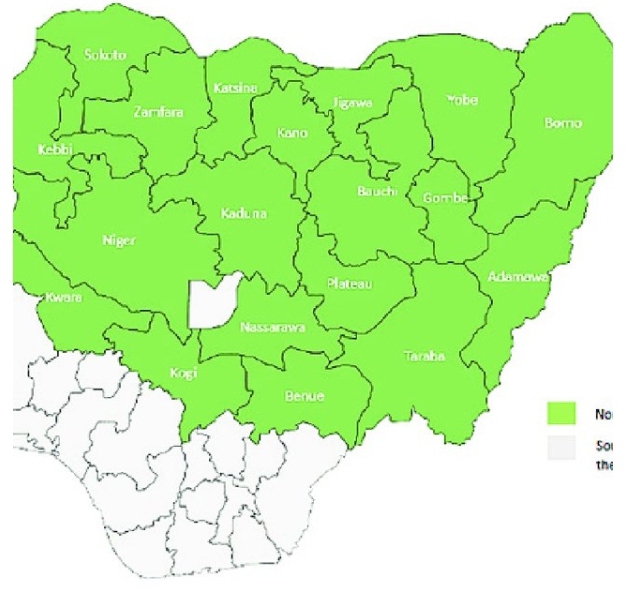

As of 2023, Nigeria’s poverty rate hovered around 40%, with over 80 million people living below the poverty line. Any reduction in social services would aggravate this crisis, leaving more people in the clutches of poverty. Additionally, unemployment remains high, with youth unemployment reaching an alarming 53.4%, according to the National Bureau of Statistics. In a country where economic disparity is already a deep-rooted issue, slashing social services would only increasingly widen the already widen gap between the rich and the poor.

The World Bank’s advice is not without precedent. Similar recommendations have been made to many African countries in the past, often under the umbrella of economic reforms. According to the World Bank, Nigeria must maintain its economic reforms for the next 10 to 15 years if it hopes to establish itself as a leading economic power, not just in sub-Saharan Africa, but globally. These reforms, it argues, are essential for sustainable growth and development, positioning Nigeria to compete with other emerging economies.

Read Also: African Poverty is Not an Act of God

But is this the right path for Nigeria? Historically, the advice of international financial institutions like the World Bank has had mixed results in Africa. Afenifere’s warning is grounded in decades of experience with global institutions whose policies have sometimes brought more harm than good.

The Bretton Woods Institutions—the International Monetary Fund (IMF) and the World Bank—have a long and complicated history in Africa. Established in the aftermath of World War II to foster global financial stability and economic development, their original goals were to rebuild war-torn economies and promote international trade. However, over time, their roles shifted. They became key players in the economic management of developing countries, especially in Africa.

But with this shift came criticism. Many argue that these institutions serve Western interests, often at the expense of African economic sovereignty. This perception is not unfounded. Africa has, at times, seen its economies destabilized by the very policies that were meant to support them.

One of the most controversial aspects of the IMF and World Bank’s involvement in Africa is their implementation of Structural Adjustment Programs (SAPs) in the 1980s and 1990s. These programs were intended to help struggling economies by offering financial assistance, but only on the condition that the countries reformed their economic policies. These reforms typically included austerity measures such as cutting public spending, privatizing state-owned enterprises, and removing trade barriers.

While SAPs may have been well-intentioned, their impact on African economies was often devastating. In Nigeria, for instance, SAPs led to a significant reduction in government spending on health, education, and agriculture. Agricultural subsidies were slashed, leading to increased food insecurity, while reduced spending on healthcare and education caused an overall decline in social welfare.

For many countries, SAPs worsened poverty and inequality. Local industries were decimated and unable to compete with imported goods after trade barriers were removed through globalization. Unemployment rose, and the gap between the rich and the poor widened. Critics argue that these programs were more focused on promoting Western economic ideologies than addressing the unique social and economic realities of African nations.

Read Also: Nigeria’s Wicked Generations: From Slave Traders to Corrupt Youths

In addition to the damage caused by SAPs, many African nations, including Nigeria, found themselves trapped in a cycle of debt dependency. Countries borrowed from the IMF and World Bank to repay existing loans, creating a never-ending loop of borrowing and repayment that left little room for genuine development.

Zambia and Mozambique are prime examples of countries that have fallen victim to this debt trap. In 2023, Zambia faced a debt crisis that was partly the result of borrowing from international financial institutions. The country’s debt burden limited its ability to invest in healthcare, education, and infrastructure, leaving its population struggling to meet basic needs.

Nigeria, too, has not escaped this cycle. As of 2023, Nigeria’s public debt stood at approximately $103 billion. This staggering figure has strained the government’s ability to fund critical social services and infrastructure projects. The World Bank’s advice to reduce social services would only deepen this crisis, as the country would be forced to cut essential programs to service its debt.

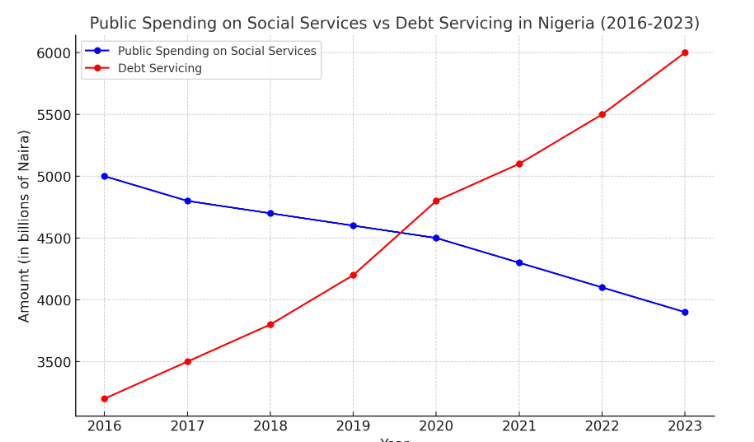

Here is a visualization chart comparing Public Spending on Social Services with Debt Servicing in Nigeria from 2016 to 2023.

The chart highlights how debt servicing has increased steadily, while spending on essential social services has been declining, reflecting the financial pressures on the Nigerian government.

This trend emphasizes the risk posed by adopting the World Bank’s advice to reduce support for social services, as continued prioritization of debt servicing could worsen socio-economic conditions for the Nigerian populace.

A common criticism of the IMF and World Bank is that their policies often undermine the economic sovereignty of African countries. By imposing conditions on loans, these institutions exert undue influence over domestic policies. Countries like Nigeria are forced to adopt policies that prioritize international capital and open markets, rather than focusing on local needs.

This dynamic has led some to accuse the IMF and World Bank of operating as instruments of neocolonialism, using financial aid as a means to control the economic policies of developing nations. African countries are often treated as recipients of advice, rather than partners in decision-making, which has led to resentment and frustration.

Afenifere’s warning to the Federal Government is a call to action. It is a reminder that Nigeria must learn from the past and approach the advice of international financial institutions with caution. President Olusegun Obasanjo provides a useful case study. During his time in office, Obasanjo skilfully navigated the waters of international economic advice. While he accepted assistance from institutions like the World Bank, he was careful to discard policies that would harm Nigeria’s social fabric.

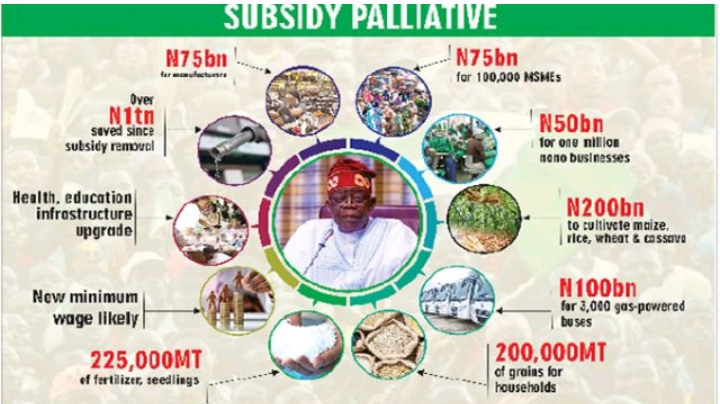

Obasanjo’s administration rejected austerity measures that would have gutted social services and instead focused on debt relief, securing a historic write-off of $18 billion in debt in 2005. This allowed Nigeria to invest in critical infrastructure and social programs, providing a blueprint for how to engage with international financial institutions without sacrificing national interests.

The Nigerian people are already suffering under the weight of economic hardship. Inflation reached 25.4% in 2023, and food prices have skyrocketed, with many families struggling to afford basic necessities. The World Bank’s advice to reduce government support for social services would exacerbate this suffering, pushing more people into poverty and undermining the country’s fragile social fabric.

Afenifere’s warning highlights the unbearable agony that would result from such cuts. Healthcare, education, and welfare programs are already underfunded, and any further reductions would have catastrophic consequences. The World Bank’s advice must be carefully scrutinized to ensure that Nigeria’s most vulnerable populations are not left to bear the brunt of economic reforms.

The advice from the World Bank is not inherently wrong, but it must be approached with caution. Nigeria’s economic challenges are complex, and solutions that work in one context may not work in another. The key is to strike a balance between necessary reforms and the protection of social services that millions of Nigerians rely on.

Read Also: Outdated Laws, Modern Realities: The Urgent Need to Modernize Nigeria’s Legal Framework

Rather than cutting social services, Nigeria should look for innovative ways to empower its citizens. Nigeria’s government must prioritize the needs of its people, ensuring that any economic reforms do not come at the expense of the most vulnerable. By learning from past mistakes and pursuing innovative, locally-driven solutions, Nigeria can chart a path toward sustainable growth without sacrificing its social fabric.

Afenifere’s warning should serve as a wake-up call. The stakes are high, and the wrong choices could plunge the country deeper into crisis. But with the right policies, Nigeria has the potential to not only recover but to thrive in the years to come.

References:

National Bureau of Statistics (NBS) – For data on public spending on social services, poverty rates, unemployment, and other social indicators.

Debt Management Office (DMO) – For information on Nigeria’s debt servicing and financial obligations.

World Bank – For historical data on Nigeria’s economic reforms and the advice to reduce social services.

International Monetary Fund (IMF) – For insights on Structural Adjustment Programs (SAPs) and their impact on developing economies, including Nigeria.

UN Human Development Reports – For statistics on social development, such as healthcare, education, and life expectancy in Nigeria.

Central Bank of Nigeria (CBN) – For economic data and policy reports, particularly on Nigeria’s fiscal strategies.

Born in Ekiti State, Nigeria, Idowu Faleye is a Policy Analyst and IBM-certified Data Analyst with an academic background in Public Administration. He’s the Lead Analyst at EphraimHill Data Consult and the Publisher of EphraimHill DataBlog, which posts regular topics on issues of public interest. He can be reached via WhatsApp at +2348132100608 or email at ephraimhill01@gmail.com

© 2024 EphraimHill DC. All rights reserved.This article is the intellectual property of EphraimHill DataBlog. For permission requests, please contact EphraimHill DC at ephraimhill01@gmail.com.

![The Trend of Insecurity in Nigeria. [Part 2]](https://ephraimhilldc.com/wp-content/uploads/2024/09/Computer-Monitoring-of-Remote-areas.png)