Written By Idowu Ephraim Faleye – +2348132100608

The global billionaire landscape is dynamic and ever-evolving, reflecting the shifting sands of economic power, industry dominance, and societal change. As of 2023, the world boasts 4,760 billionaires, a testament to the relentless march of capitalism and innovation. This growing class of ultra-wealthy individuals is not evenly distributed across the globe; rather, it is concentrated in specific regions, industries, and demographics, revealing much about the underlying structures of wealth creation and accumulation.

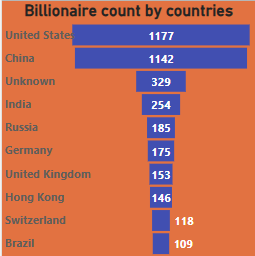

The United States continues to lead the world in the number of billionaires, with 1,177 individuals holding the status of billionaire in 2023, a slight decline from previous years. This dominance is not merely a reflection of the country’s large economy but also its robust financial markets, technological innovation, and entrepreneurial culture. American billionaires collectively hold a significant portion of global wealth, underscoring the nation’s central role in the global economic system.

China, while trailing the U.S., remains a formidable player with 1,142 billionaires in 2023. This figure underscores China’s rapid economic development, state-supported industries, and an expanding middle class that fuels domestic consumption. The Chinese government’s strategic investments in technology and manufacturing have created fertile ground for wealth generation, propelling entrepreneurs to billionaire status.

India holds the third position globally, with 254 billionaires, reflecting its burgeoning economy and the rise of new wealth in sectors like technology, pharmaceuticals, and manufacturing. The country’s demographic dividend, coupled with a growing startup ecosystem, has contributed to this increase, signaling India’s potential as a future economic powerhouse.

Beyond these top three, countries like Germany, Russia, and Brazil also feature prominently in the billionaire rankings, each with unique economic structures and industries that facilitate wealth accumulation. Germany’s strength in manufacturing and engineering, Russia’s natural resources, and Brazil’s diverse economy all play roles in their respective billionaire counts.

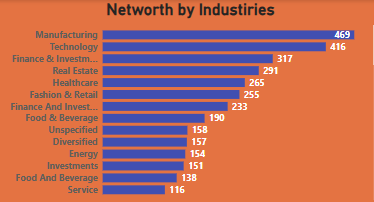

Industry-wise, Manufacturing remains the leading sector for billionaire wealth, accounting for496 billionaires in 2023. This sector’s dominance is attributed to the significant returns on investment capital. Technology follows with 416 billionaires highlighting the transformative impact of digital innovation and the internet economy. Finance & Investment follows owing to the high scalability of financial services. Real estate and healthcare also contribute substantially to the billionaire population, each offering unique opportunities for wealth creation through scale, innovation, and essential services.

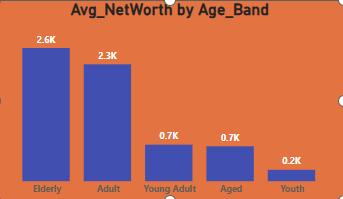

The age distribution of billionaires reveals that wealth accumulation is often a long-term endeavor. Nearly half of the world’s billionaires are between 50 and 70 years old, while more than 40% are above 70. This suggests that experience, time, and sustained business growth are critical factors in reaching billionaire status. However, a notable trend is the emergence of younger billionaires, particularly in the tech sector, where innovation and rapid scalability can lead to significant wealth in a relatively short period.

Gender disparities persist within the billionaire class. As of 2023, only 9.56% of the world’s 4,760 billionaires are women, highlighting ongoing challenges in achieving gender parity in wealth accumulation. While the number of female billionaires is gradually increasing, systemic barriers and historical inequalities continue to limit women’s representation at the highest levels of wealth. Efforts to promote gender equity in entrepreneurship, access to capital, and leadership positions are essential to address this imbalance.

The global distribution of billionaire wealth also reflects broader economic trends and shifts in geopolitical influence. The concentration of billionaires in certain countries underscores the importance of stable political environments, favorable regulatory frameworks, and access to global markets in facilitating wealth creation. Conversely, regions with fewer billionaires may face challenges such as political instability, limited access to capital, or underdeveloped infrastructure, which can hinder economic growth and wealth accumulation.

The origins of billionaires are also intertwined with education, networks, and inheritance. Many of the world’s wealthiest individuals come from privileged backgrounds, often with access to elite education, startup capital, or established business empires. However, a significant proportion of billionaires are self-made, having risen from modest beginnings to create successful enterprises through innovation, grit, and strategic decision-making. This duality highlights both the potential for social mobility and the entrenched structures that can preserve wealth across generations.

Another notable dimension is the role of family dynasties in global billionaire demographics. In regions such as Europe and parts of Asia, wealth tends to remain within families across multiple generations. The Walton family in the United States, owners of Walmart, remains a classic example of inherited wealth. Similarly, family-owned conglomerates in India, South Korea, and Germany have solidified multigenerational billion-dollar fortunes, often blending tradition with modern business practices.

Tax policy, economic incentives, and regulatory conditions also shape the billionaire landscape. Countries that provide favorable tax environments, such as low capital gains tax or no inheritance tax, often attract and retain billionaires. In contrast, discussions around wealth taxes and income redistribution policies have led to tensions in some countries, where billionaires are increasingly under public scrutiny. The balance between encouraging innovation and ensuring equitable wealth distribution remains a contentious issue in both developed and developing economies.

Read Also: When Giants Clash: USA and China Tariff War Could Collapse the Global Order

Climate change, sustainability, and social responsibility have also entered the billionaire discourse. Some of the world’s richest individuals are now spearheading philanthropic initiatives or investing in green technologies. The rise of ESG (Environmental, Social, and Governance) investing reflects this shift, as wealth is increasingly being aligned with values-driven impact. Yet, critics argue that such efforts often fall short of addressing the deep-rooted inequalities associated with extreme wealth concentration.

The COVID-19 pandemic further exposed the divergent fortunes of billionaires and the rest of the world. While many sectors suffered economically, billionaires in technology, healthcare, and logistics saw massive surges in their net worth. This disproportionate wealth accumulation during a global crisis reignited debates about capitalism’s moral compass and the sustainability of current economic systems. At the same time, it showcased how global disruptions can rapidly reshape the hierarchy of wealth and power.

As the world becomes more digital and interconnected, the barriers to wealth creation are simultaneously falling and rising. On one hand, anyone with an internet connection and a novel idea can launch a business, scale globally, and join the billionaire club. On the other hand, the consolidation of capital, data, and market access by major tech platforms creates high entry barriers for new competitors. This paradox continues to shape the conversation about inclusive growth in the 21st century.

Read Also: Forgotten and Forsaken Inside the Nigerian Prison System

Looking forward, Africa and Southeast Asia present significant potential for the next wave of billionaire growth. These regions are poised for economic takeoff with young populations, increasing internet penetration, and expanding middle classes. However, to unlock this potential, governments must prioritize investment in infrastructure, education, and regulatory frameworks that support entrepreneurship and innovation.

In summary, the question of where the richest people in the world come from is more than a geographical inquiry. It is a window into the engines of global capitalism, the inequalities and opportunities it produces, and the social contracts that bind economies together. From Silicon Valley to Shenzhen, Mumbai to Moscow, the rise of billionaires tells a story of ambition, systems, and the evolving relationship between wealth and society. As the next chapter unfolds, the distribution and character of billionaires will continue to reflect broader truths about our world—and the future we are all creating.

Idowu Faleye is the founder and publisher of EphraimHill DataBlog, a platform committed to Data Journalism and Policy Analysis. With a strong background in Public administration and Data Analytics, his articles offer research-driven insights on Politics, governance and Public Service delivery

![The Trend of Insecurity in Nigeria. [Part 2]](https://ephraimhilldc.com/wp-content/uploads/2024/09/Computer-Monitoring-of-Remote-areas.png)